- August 29, 2022

Solana price Forecast: Is the SOL price rising now?

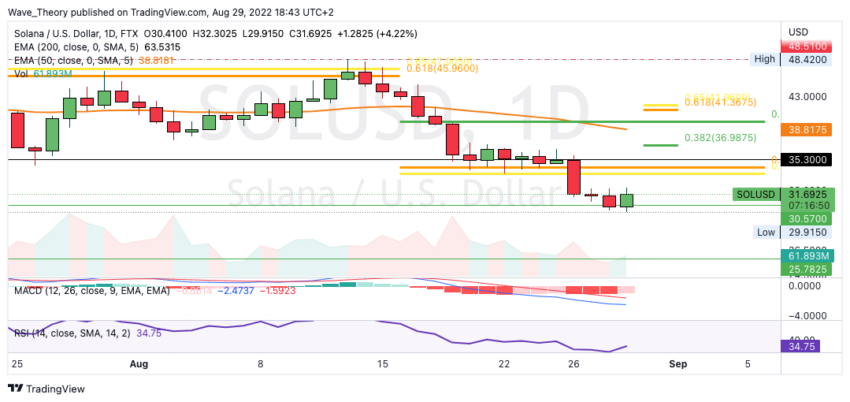

Solana price has broken the Golden Ratio support at around $ 34 bearish and fell back to the $ 30 mark.

In the last Solana price forecast, we wrote: “The Solana price failed three times to break the Golden Ratio resistance at around $ 46. Following the third failed attempt, the Solana price corrected very strongly, breaking both the 50-day EMA and the 0.382 Fib support at around $ 40 to return directly to the Golden Ratio support at around $34.

Once there, the Solana price could now bounce to target the 0.382 Fib resistance at around $40. On the other hand, if the Solana price breaks the Golden Ratio support at around USD 34 bearishly, it could return to the annual low at around USD 26.“

Solana price has broken the Golden Ratio support bearishly at around 34 USD

The Solana price has broken the Golden Ratio support bearishly at around 34 USD and fell to around 30 USD. Once there, the SOL course could bounce off. Thus, the next significant resistances are waiting for Solana at around $ 35, $ 37 and $ 42.

In addition, the histogram in the daily chart is ticking bullish higher today, after ticking bearish lower for the last three days. In addition, the MACD lines are bearishly crossed, while the RSI is neutral.

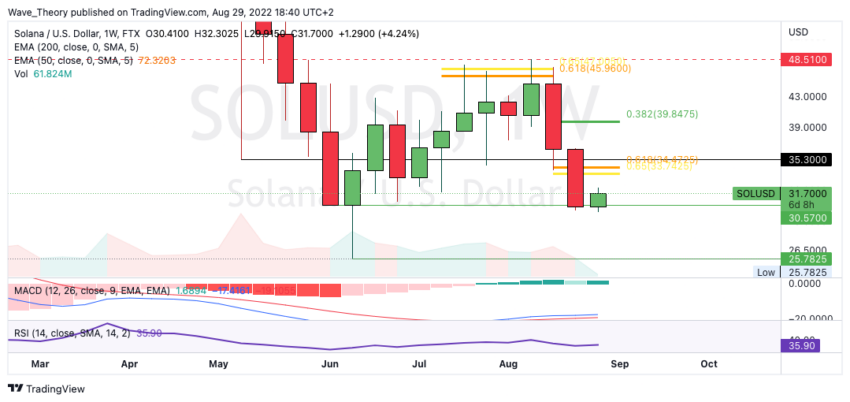

Solana course returned to the weekly closing price of June at around 30 USD

The Solana price was able to bounce at around 30 USD at the end of the week in June, instead of falling to the annual low at around 26 USD. Nevertheless, the SOL price could reach the annual low at around $ 26 again, if Solana does not overcome the Golden Ratio resistance at around $ 42.

On the weekly chart, the histogram of the MACD ticked bearishly lower last week. This week it starts to tick bullish higher and the MACD lines are still crossed bullish. The RSI is neutral.

The RSI has a bullish divergence on the 4H chart

In the 4H chart, the RSI showed a bullish divergence, after which the SOL price could already rise from around 30 USD to around 32 USD. In addition, the histogram of the MACD ticks bullish higher on the 4H chart and the MACD lines are crossed bullish.

In contrast to these bullish signals, a death cross was established in the 4H chart, which confirms the trend bearish in the short term.

Will the Solana price return to the annual low at around 26 USD?

So if Solana does not overcome the golden ratio at around USD 42, Solana could fall back to the annual low of around USD 26 in the medium term. If Solana also breaks this support, significant support is only waiting for the SOL price again at around 18 USD.

Against BTC, the SOL price will soon reach the Golden Ratio support

Against BTC, the MACD lines are also bearishly crossed in the daily chart. However, the histogram of the MACD has been ticking bullish higher since yesterday, while the RSI is neutral.

Soon the SOL price could reach the Golden Ratio support at around 0.00148 BTC, where SOL could bounce very strongly. At around 0.00184 BTC, the decisive Fib resistance is.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.